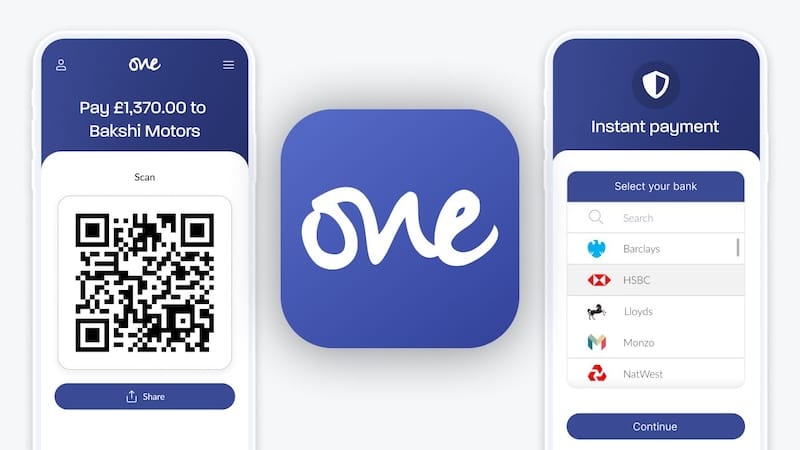

Introducing One: Instant payments, in your pocket.

Carmen James - 23rd May, 2023

Wonderful Payments, an FCA-authorised Open Banking provider, is delighted to announce the launch of a simple, user-friendly point-of-sale mobile app for UK businesses.

The One app takes full advantage of Wonderful’s slick, instant bank payments, allowing merchants to process 1,000 transactions each month—both in person and remotely—for a single subscription fee of £9.99 per month (all transactions outside the bundle are also charged at just 1p per transaction).

The traditional approach

Before we take a look at the instant payment solutions our One app provides, let’s spend a moment understanding the challenges that traditional payment systems pose for businesses in the UK:

- High transaction fees: Traditional payment methods, typically using credit/debit cards, usually carry significant transaction fees that reduce business profitability. Factors such as card type, processing network, and transaction volumes all have a bearing on the extent of charges levied per usage. This makes it difficult for organisations to predict costs and model pricing. Percentage-based fees are a double-edged sword. While every business seeks to increase its sales volume, this approach to transaction fees clearly impacts profitability.

- Delayed payment settlement: Delayed payments are becoming silent killers for Britain’s small and medium businesses. Settlement periods imposed by traditional payment processors can range from a few days to several weeks. Waiting for unreleased funds can create huge cash flow challenges for enterprises operating on tight budgets or battling increased overhead costs. Payroll management, supplier payouts, and sales promotions can be severely impacted if payments are not settled on time. The Federation of Small Businesses (FSB), UK, reveals that nearly 50,000 businesses are compelled to shut down due to payment bottlenecks (read our in-depth blog post at https://wonderful.co.uk/blog/getting-paid-is-killing-smes).

- Security concerns: Cybersecurity threats and data breaches are an increasing concern not just for businesses but also for their customers. Transactions carried out over conventional card networks may require businesses to store sensitive customer data, potentially jeopardising their systems as well as the consumers’ security. Any unintended data compromise can severely impact their customer relationship and future business potential.

- Complex payment processes: Traditional payment methods can be burdensome and time-consuming for customers and enterprises alike. For instance, online transactions require the input of multiple data points, such as the name on the card, expiration date, Card Verification Value (CVV), first line of address, postcode, etc. They complicate the process and leave room for human errors, leading to failed checkout. This can further lead to incomplete transactions and abandonment as frustrated customers leave purchases at checkout due to the lengthy procedure. Even physical transactions require swiping the card or inserting it into card terminals and punching the security pin, often hindered by malfunctioning swiping machines. For businesses, too, it becomes a logistical challenge to maintain records of multi-channel transactions and reconcile the data periodically.

How does Wonderful provide solutions?

Its first release of the One app allows businesses to use Open Banking to take instant bank payments for products and services or bill hours and view a dashboard with order, payment, and customer history. QR codes can be shown to customers for face-to-face transactions, whilst secure payment links may be shared via other channels, including SMS, email, and WhatsApp, for payments where the customer is not present.

Providing a highly competitive alternative to traditional card payments, One brings instant settlement, improved security, and minimised data entry to the payment experience. Wonderful’s inclusive subscriptions also eliminate percentage-based transaction fees, offering businesses substantial savings on processing fees, especially on high-value transactions.

The CSR perspective

Corporate Social Responsibility (CSR) has been on the radar for some time for UK business owners. However, resource-intensive charity initiatives, like fundraising events, donation boxes at strategic locations, etc., can be difficult to organise. Thus, despite the best of intentions, some firms may refrain from embarking on a charitable mission. This is where Wonderful steps in.

Wonderful is synonymous with social responsibility. With CSR baked into our model and origin, our Open Banking payment technology was first developed to challenge the notion that fee-free fundraising was impossible. The online giving platform we operate at Wonderful.org embodies tech-for-good, saving charities thousands of pounds on processing and platform fees, which can instead be sent directly to the frontline causes that depend upon them.

“Since 2016, Wonderful has enabled fundraisers and donors to raise millions of pounds for UK charities with no deductions whatsoever. Now, businesses and their customers will extend Wonderful’s reach and impact whilst enjoying the speed, simplicity, security, and savings the One app delivers,” said founder, Kieron James.

“We are very excited about the app. It reflects the talent of a dedicated team to bring payments innovation to businesses, significantly reducing processing fees at a time when everybody is very focused on cost saving,” added James.

The Wonderful way

Wonderful is much more than an instant bank payment solution - or the giving platform at wonderful.org which it has always operated completely free of charge. It’s a movement for good that benefits everybody—not just thousands of worthy causes, but the whole community: donors, fundraisers, employees, consumers, the giving platform's corporate sponsors, and, of course, its commercial Wonderful payment, the customer and merchant join a virtuous circle that enables millions of pounds to be generated by charity fundraisers, with no additional cost to anybody.

Wonderful will continue to build on its commercial services throughout 2024. Soon, even more integrations with eCommerce platforms will sit alongside our WooCommerce plugin. We will add new accounting platforms to accompany our Xero integration, and these will allow online store owners and offline retailers to take advantage of Wonderful’s instant payments whilst supporting vital charitable causes at no extra cost.

To find out more about the One payments app, visit wonderful.one or email us at [email protected].

About Wonderful Payments

Expensive card networks have dominated the payments landscape for decades because there have been few viable, or less costly, alternatives. Until now.

Open Banking clears the way for a much better deal, allowing businesses to initiate instant payments directly from customer accounts, whilst slashing fees. But Wonderful is much more than a payment solution - or the giving platform at wonderful.org which it has always operated completely free of charge. It’s a movement for good that benefits everybody; not just thousands of worthy causes, but the whole community: donors, fundraisers, employees, consumers, the giving platform's corporate sponsors and, of course, its commercial clients.

Choosing Wonderful at checkout creates real, positive impact. Simply by making or receiving a Wonderful payment, the customer and merchant join a virtuous circle that enables millions of pounds to be generated by charity fundraisers, with no additional cost to anybody.

Register today with a seven day, full refund guarantee.