What to look for in POS systems: minimised hardware

Gabi James - 13th Jun, 2023

POS systems with a web of devices like card terminals and tablets are cumbersome and expensive - but there's another way.

In the penultimate instalment of our Point of Sale solution series, we’re turning our attention to the physical devices each system requires. As with most things in the modern age, the answer here is quite simple: less is more.

To really make sure you’re choosing the best Point of Sale system for your business, make sure you catch up on our previous articles, which cover:

And come back for our final post about integrating with your existing processes.

But for now, let’s delve into how you can streamline the hardware you’re using at the point of sale.

What is a Point of Sale system made up of?

First, let’s recap some of the ground we covered in our introductory Point of Sale article by thinking about what’s included in a POS system.

At pretty much any point of sale, there’ll be:

- A buyer

- A seller

- A product or service

- An exchange of money

- A POS system facilitating this exchange

A POS transaction doesn’t need to involve hi-tech hardware: any monetary exchange processed through a POS system counts. That could mean passing a handful of change into a biscuit-tin-cum-cash-register.

Of course, most companies nowadays need a more sophisticated approach. Typically, a modern POS system integrates lots of tools, from cash registers to receipt printers, iPads to card terminals. Some POS providers make you buy or rent hardware from them, while others let you use your own.

The problem with complex POS systems

As many retailers know, all this hardware is expensive to buy and maintain. It’s also less sustainable environmentally as well as financially.

On top of that, it makes you less mobile and adaptable, and it adds more plates for your staff to keep spinning as they work.

And all of that is assuming the hardware itself works reliably. The reality is, it often fails or lags. How many of us have waited – with varying levels of patience – for a card terminal to read our card or process our payment? How many times each day do staff type in the wrong amount or item by mistake, and have to void the transaction and begin all over again?

As well as technical failures, hardware is prone to damage, be it by the elements (in the UK we have plenty of rain to contend with), accidents (in the hands of staff or clumsy customers), or even theft. If you’re using expensive equipment like iPads and tablets, these costs can rack up.

Modernising the POS experience

Over the past few decades, the cash register has largely given way to electronic retail POS systems that process credit cards and debit cards. Most modern ePOS systems include:

- A computer

- A cash register

- Card payment terminals

- Receipt printers

- Customer displays

- Barcode scanners

- Tablets and/or smartphones

With so many tools to juggle, it’s no wonder more and more merchants are realising it’s time for a change.

And customers agree, as even chip and PIN transactions seem old-fashioned. Consumers have grown accustomed to MPOS or Mobile POS solutions – they want to pay quickly and easily, via mobile wallets and without any contact or need to enter a PIN.

The future of POS solutions

Enter Open Banking, which makes direct and instantaneous account-to-account payments possible – without card readers, PINs, or faulty NFC sensors. In comparison, even contactless card payments feel clunky and inconvenient.

FCA-regulated Open Banking payment providers like Wonderful make the POS experience seamless for both customers and businesses.

There’s no longer the need for businesses to shell out for any hardware – not a cash register, not a card reading terminal, not a tablet in sight. Instead, customers scan a QR code and are taken to their banking app to approve a pre-filled transaction to your business’s bank account.

Not only is this a quicker experience for them, it also means your business receives funds immediately rather than days later, and saves you a huge amount on card processing fees. Not to mention all the savings on buying, renting, maintaining, repairing and replacing hardware!

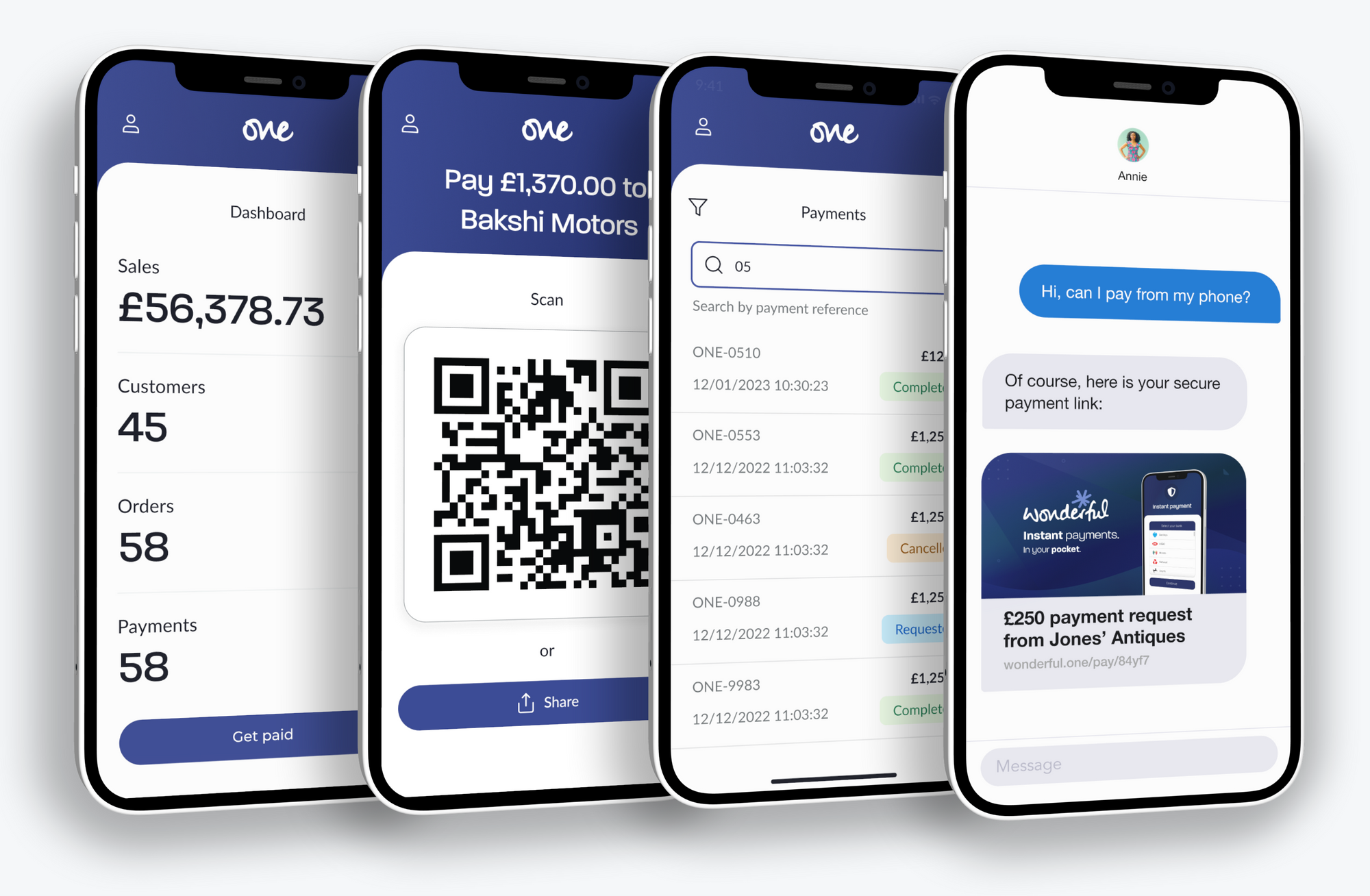

To manage, track and analyse finances, you can use our intuitive, free One app. There, you can manage and add admins, and see all of the sales data at a glance, including:

- Total revenue

- Number of customers

- Number of orders

- Number of payments

On the app, you can also create new orders easily, giving you and your staff individual links and QR codes as needed so that customers are presented with prepopulated payments – the amount and recipient filled in, so all they need to do is approve the payment.

Best of all, you get 1,000 transactions for just £9.99 per month (that's just 1p per transaction!). And you can try it for free with our no strings attached 14-day trial.

Embrace the future of Point of Sale systems

To future-proof your business, provide Open Banking instant bank payments at the point of sale.

Not only will you get the newest and simplest payments technology, but you’ll enjoy a whole host of benefits like:

- Increased satisfaction for staff and customers

- A streamlined checkout process

- Boosting sales

- Reducing costs

- Instant payments

- Heightened security

- Inherent CSR

Plus, our friendly team is on-hand to support you through the simple onboarding and integration process, so that you can have instant payments sitting alongside your existing methods in no time. Get started with a FREE TRIAL today!